One of the most common questions beginners ask when starting their crypto journey is: "How much should I invest in crypto monthly?"

It's a smart question. You want to invest enough to see meaningful growth, but not so much that it puts your financial security at risk. The good news is there's a systematic way to figure this out—and you don't need to be a financial expert to do it.

This guide will walk you through determining the right crypto DCA amount for your situation, using practical formulas and a crypto DCA calculator approach that helps you make informed decisions.

Table of Contents

- Why Investment Sizing Matters

- The 5-10% Rule: A Starting Point

- Factors That Affect Your Crypto DCA Amount

- Crypto DCA Calculator: Practical Examples

- The Crypto DCA Calculator Formula

- Building Your Own Crypto DCA Calculator

- Common Investment Sizing Mistakes to Avoid

- Real-World DCA Amount Recommendations by Income

- How to Increase Your Crypto DCA Amount Over Time

- Using Your Crypto DCA Amount to Plan Long-Term Goals

- Your Action Plan: Determine Your Crypto DCA Amount

- Tools to Help Calculate Your Crypto DCA Amount

- Key Takeaways: How Much to Invest in Crypto Monthly

- Start Your Calculated Crypto Investment Journey

Why Investment Sizing Matters

Before diving into the numbers, let's understand why getting your crypto investment amount right matters:

- Too little and you might not see meaningful growth, even over years

- Too much and you risk financial stress if the market dips

- Just right and you build wealth systematically without compromising your lifestyle

The key is finding your personal sweet spot—an amount that feels comfortable and sustainable long-term.

The 5-10% Rule: A Starting Point

A common guideline in the crypto community is the 5-10% rule: Invest 5-10% of your monthly disposable income in cryptocurrency.

Disposable income = Your monthly income minus:

- Essential expenses (rent, utilities, food, transportation)

- Debt payments

- Emergency fund contributions

- Other savings goals (retirement, vacations, etc.)

Example Calculation

Let's say you earn $5,000 per month after taxes:

- Monthly expenses: $3,000 (rent, food, bills, etc.)

- Debt payments: $400

- Emergency fund: $300

- Other savings: $200

Disposable income = $5,000 - $3,000 - $400 - $300 - $200 = $1,100

5-10% of disposable income = $55 - $110 per month

So according to the 5-10% rule, you'd invest $55-110 per month in crypto.

This is a conservative, safe starting point that won't jeopardize your financial security.

Factors That Affect Your Crypto DCA Amount

The 5-10% rule is a guideline, not a rule. Your ideal monthly crypto investment amount depends on several factors:

1. Your Financial Situation

- Stable income: If you have a steady job with reliable income, you might feel comfortable investing more

- Irregular income: If you're a freelancer or contractor, be more conservative until you build a larger emergency fund

- Debt: High-interest debt (credit cards, payday loans) should be paid off before increasing crypto investments

- Savings: Only invest money you don't need for emergencies or short-term goals

2. Your Risk Tolerance

- Conservative: If market volatility makes you anxious, stick to the lower end (5% or less)

- Moderate: Comfortable with some risk? You might go up to 10-15%

- Aggressive: Very high risk tolerance? Some investors go 20%+, but this isn't recommended for beginners

Remember: Crypto is volatile. Only invest what you can afford to lose entirely without affecting your quality of life.

3. Your Investment Goals

What are you investing for?

- Long-term wealth building (10+ years): You might invest more consistently

- Specific goal (house down payment, retirement): Calculate based on timeline and target amount

- Education/learning: Start smaller and increase as you learn

4. Your Time Horizon

- Short-term (1-3 years): Be more conservative with your crypto investment amount

- Medium-term (3-7 years): Moderate amounts work well

- Long-term (7+ years): You can be more aggressive since you have time to recover from downturns

5. Your Experience Level

- Beginners: Start small ($50-200/month) regardless of income

- Experienced: As you understand the market better, you might increase your allocation

- Experienced traders: Some allocate more, but this requires deep market knowledge

Crypto DCA Calculator: Practical Examples

Let's walk through some real-world examples using a crypto DCA calculator approach:

Scenario 1: Recent College Graduate

Profile:

- Monthly income: $3,500 after taxes

- Monthly expenses: $2,500

- Disposable income: $1,000

- Emergency fund: Building (not fully funded yet)

- Risk tolerance: Moderate

- Experience: Beginner

Calculation:

- Use 5% of disposable income (conservative for beginner)

- Monthly crypto DCA: $1,000 × 5% = $50 per month

Rationale: Small enough to be affordable, but enough to start building. Can increase once emergency fund is complete.

Scenario 2: Mid-Career Professional

Profile:

- Monthly income: $7,000 after taxes

- Monthly expenses: $4,000

- Disposable income: $3,000

- Emergency fund: Fully funded (6 months expenses)

- Risk tolerance: Moderate to aggressive

- Experience: Some crypto knowledge

Calculation:

- Use 8% of disposable income (moderate risk, stable situation)

- Monthly crypto DCA: $3,000 × 8% = $240 per month

Rationale: Comfortable financial situation allows for higher allocation. Can diversify into multiple cryptocurrencies.

Scenario 3: High Earner, Conservative

Profile:

- Monthly income: $12,000 after taxes

- Monthly expenses: $5,000

- Disposable income: $7,000

- Emergency fund: Fully funded

- Risk tolerance: Conservative (prioritizing security)

- Experience: Beginner to intermediate

Calculation:

- Use 7% of disposable income (conservative despite high income)

- Monthly crypto DCA: $7,000 × 7% = $490 per month

Rationale: High income doesn't mean you should invest more if you're risk-averse. Consistency and comfort matter more.

Scenario 4: Student / Part-Time Worker

Profile:

- Monthly income: $1,500 after taxes

- Monthly expenses: $1,200

- Disposable income: $300

- Emergency fund: Minimal

- Risk tolerance: Low (need money for school)

- Experience: Beginner

Calculation:

- Use 3% of disposable income (very conservative for student)

- Monthly crypto DCA: $300 × 3% = $9 per month (round up to $10-25)

Rationale: Focus on finishing education and building emergency fund first. Crypto investment is minimal but establishes good habits.

The Crypto DCA Calculator Formula

Here's a simple formula you can use to calculate your ideal monthly crypto investment amount:

Basic Formula

Monthly Crypto DCA = (Monthly Disposable Income × Risk Percentage) ÷ Frequency

Where:

- Monthly Disposable Income = Income - Essential Expenses - Debt - Savings

- Risk Percentage = 5-10% (conservative) or 10-20% (aggressive)

- Frequency = How many times per month you invest (if weekly, divide by 4; if bi-weekly, divide by 2)

Advanced Formula (Including Portfolio Allocation)

Monthly Crypto DCA = (Total Portfolio Value × Crypto Allocation %) ÷ 12

Where:

- Total Portfolio Value = Your total investable assets

- Crypto Allocation % = 5-10% (recommended for most investors)

- 12 = Months per year

Example: Using the Advanced Formula

If you have:

- Total investable assets: $50,000

- Crypto allocation target: 8%

- Current crypto holdings: $1,000

Target crypto portfolio: $50,000 × 8% = $4,000 Amount to invest: $4,000 - $1,000 = $3,000 Monthly DCA to reach target in 2 years: $3,000 ÷ 24 months = $125 per month

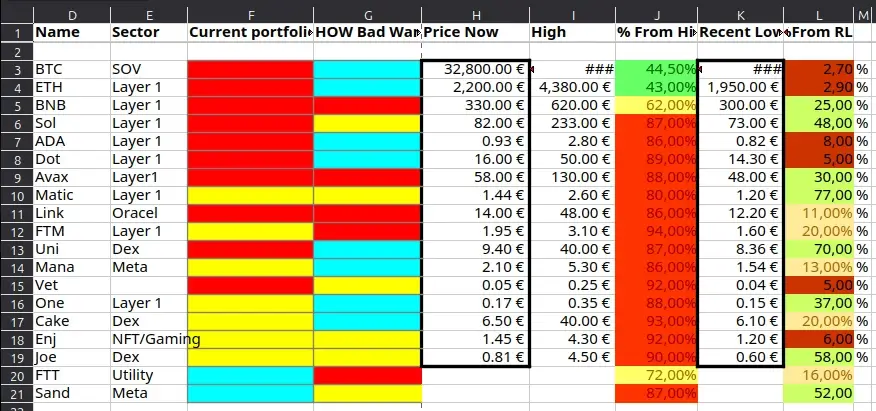

Building Your Own Crypto DCA Calculator

You can create a simple crypto DCA calculator in a spreadsheet to visualize different scenarios:

Step 1: Set Up Your Inputs

Monthly Income: $______

Monthly Expenses: $______

Debt Payments: $______

Savings Goals: $______

Emergency Fund Contribution: $______

Disposable Income: $______ (calculated)

Risk Percentage: ___%

Monthly Crypto DCA: $______ (calculated)

Step 2: Project Future Growth

Add columns to see how your investment grows:

Month | Investment | Total Invested | Est. Value (5% growth) | Est. Value (10% growth)

1 | $100 | $100 | $105 | $110

2 | $100 | $200 | $210 | $220

...

Step 3: Adjust and Compare

Try different monthly amounts to see:

- How long until you reach your goal

- Impact of increasing/decreasing your crypto DCA amount

- Growth at different return rates

Common Investment Sizing Mistakes to Avoid

When determining how much to invest in crypto monthly, avoid these mistakes:

❌ Mistake 1: Investing Too Much Too Soon

Problem: Getting excited and investing a large lump sum without testing your risk tolerance.

Solution: Start with the 5% rule, then gradually increase as you become comfortable.

❌ Mistake 2: Not Accounting for Market Volatility

Problem: Investing amounts that cause stress when prices drop 30-50%.

Solution: Only invest what you're truly comfortable losing. If a 50% drop would cause panic, you're investing too much.

❌ Mistake 3: Comparing Yourself to Others

Problem: Seeing someone invest $1,000/month and feeling like you should match it.

Solution: Everyone's financial situation is different. Your $100/month might be a larger percentage of your income than their $1,000/month.

❌ Mistake 4: Not Reviewing Regularly

Problem: Setting a crypto DCA amount and never adjusting it.

Solution: Review every 6-12 months. As your income grows, expenses change, or goals shift, adjust your investment amount accordingly.

❌ Mistake 5: Ignoring Your Emergency Fund

Problem: Investing in crypto before having 3-6 months of expenses saved.

Solution: Build your emergency fund first. Crypto investments should come after financial security is established.

Real-World DCA Amount Recommendations by Income

Here are practical monthly crypto investment recommendations based on income levels:

Under $2,500/month

- Recommendation: $25-50/month

- Focus: Building emergency fund and essential savings first

- Priority: Financial stability before growth

$2,500 - $5,000/month

- Recommendation: $50-200/month

- Focus: Balance between growth and stability

- Priority: Establish consistent DCA habit

$5,000 - $10,000/month

- Recommendation: $200-500/month

- Focus: Accelerated wealth building

- Priority: Diversify across multiple cryptocurrencies

Over $10,000/month

- Recommendation: $500-1,000+/month (based on 5-10% of disposable income)

- Focus: Significant portfolio growth

- Priority: Professional portfolio management strategies

Remember: These are general guidelines. Your specific situation, risk tolerance, and goals matter more than your income level.

How to Increase Your Crypto DCA Amount Over Time

As you become more comfortable and your financial situation improves, you can gradually increase your monthly crypto investment:

Year 1: Foundation Phase

- Start with 5% of disposable income

- Focus on consistency

- Learn about the market

- Build confidence

Year 2: Growth Phase

- Increase to 7-8% if comfortable

- Add more cryptocurrencies

- Review and adjust quarterly

Year 3+: Optimization Phase

- Increase to 8-10% or more based on comfort

- Optimize your DCA schedule

- Consider more advanced strategies

Key Principle: Only increase your crypto DCA amount when:

- Your emergency fund is fully funded

- Your income has increased

- You're comfortable with current volatility

- You've learned more about crypto investing

Using Your Crypto DCA Amount to Plan Long-Term Goals

Once you've determined your monthly crypto investment amount, you can plan for long-term goals:

Goal: Build a $10,000 Crypto Portfolio

If you invest $100/month at 7% annual growth:

- Time to reach goal: ~7 years

If you invest $250/month at 7% annual growth:

- Time to reach goal: ~3.5 years

If you invest $500/month at 7% annual growth:

- Time to reach goal: ~2 years

Use a crypto DCA calculator to visualize your specific goals and adjust your monthly amount accordingly.

Goal: Retirement Crypto Allocation

Target: $50,000 in crypto by retirement (30 years away)

If investing $150/month at 8% annual growth:

- Projected value in 30 years: ~$204,000

This far exceeds the goal, showing the power of consistent DCA investing.

Your Action Plan: Determine Your Crypto DCA Amount

Ready to calculate your ideal monthly crypto investment? Follow these steps:

Step 1: Calculate Your Disposable Income

Monthly Income

- Essential Expenses

- Debt Payments

- Savings Goals

- Emergency Fund

= Disposable Income

Step 2: Choose Your Risk Percentage

- Conservative: 5%

- Moderate: 7-8%

- Aggressive: 10%+

Step 3: Calculate Your Monthly DCA

Monthly DCA = Disposable Income × Risk Percentage

Step 4: Validate Your Amount

Ask yourself:

- Can I afford this if I lose it all?

- Will this cause financial stress?

- Am I comfortable with this amount long-term?

- Do I have an emergency fund first?

Step 5: Start and Adjust

- Begin with your calculated amount

- Review every 6 months

- Adjust based on changes in income, expenses, or goals

Tools to Help Calculate Your Crypto DCA Amount

While you can calculate manually, here are some helpful approaches:

1. Simple Spreadsheet Calculator

Create a Google Sheets or Excel calculator with:

- Income and expense tracking

- Automatic DCA calculation

- Future value projections

- Goal tracking

2. Online DCA Calculators

Search for "crypto DCA calculator" tools that let you:

- Input monthly amount

- Set time horizon

- See projected growth

- Compare different scenarios

3. Stackly's Built-In DCA Planning

Platforms like Stackly help you:

- Determine your ideal DCA amount

- Automate your investments

- Track progress toward goals

- Adjust as needed

Key Takeaways: How Much to Invest in Crypto Monthly

- Start with 5-10% of disposable income as a general guideline

- Only invest what you can afford to lose—crypto is volatile

- Build your emergency fund first before increasing crypto investments

- Consistency matters more than amount—$100/month is better than $1,000 once

- Start small and increase gradually as you become comfortable

- Review and adjust regularly as your situation changes

- Don't compare to others—your financial situation is unique

- Use a crypto DCA calculator to visualize long-term growth

- Focus on your goals—align your investment amount with your timeline

Start Your Calculated Crypto Investment Journey

Determining how much to invest in crypto monthly isn't about finding the perfect number—it's about finding the right amount for your situation, your goals, and your comfort level.

The most important thing isn't the dollar amount—it's starting with something and staying consistent.

Ready to automate your calculated DCA strategy?

Stackly makes it easy to implement your crypto DCA calculator plan. Set your monthly investment amount, choose your cryptocurrencies, and let automation handle the rest. Our platform helps you:

- ✅ Calculate your ideal DCA amount based on your goals

- ✅ Automate your investments on your schedule

- ✅ Track your progress toward long-term goals

- ✅ Adjust easily as your situation changes

No complex math required. No manual calculations needed. Just set it and let it work.

Start Your Calculated DCA Strategy with Stackly → Let us help you determine the perfect monthly crypto investment amount for your situation and automate your wealth-building journey.

Remember: Your Journey, Your Pace

Every successful crypto investor started by asking: "How much should I invest?"

The answer is different for everyone, but the process is the same:

- Calculate your disposable income

- Choose a comfortable percentage

- Start small and stay consistent

- Increase gradually as you grow

Your crypto investment amount today doesn't have to be your amount forever. Start where you're comfortable, learn along the way, and adjust as you go.

The best time to start was yesterday. The second-best time is today—with an amount that makes sense for you.

Start your calculated crypto investment journey now, and watch your wealth grow systematically over time. Your future self will thank you for taking that first step, no matter how small.